Our multi network card tokenization solution

Offer your customers ease of payments and peace of mind without worrying about compliance.

Tokenization and noon payments

noon payments frees your business from needing to synchronize multiple token systems, consolidating them into one Token Vault, which covers majority of your providers and payment methods. This helps to prevent provider lock-in when businesses wish to make changes to their payment stack and opt-out of specific providers.

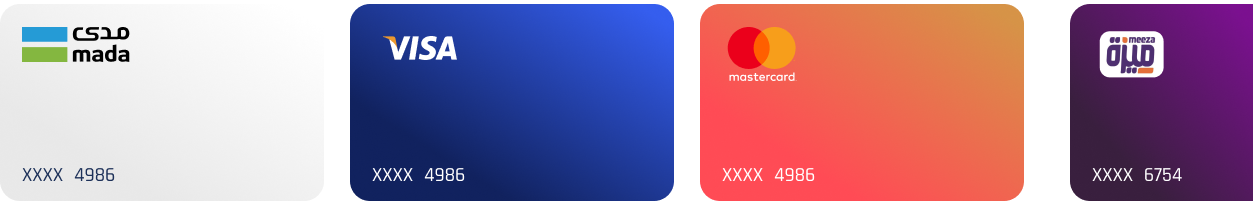

Saved Cards

Tokenization can help keep your transactions secure. How?

helps build extra trust and safety into every payment experience by replacing the card number with a unique value called a token. The merchant uses these tokens for transactions and refunds.

Our tokenization solution works with card networks to generate a network of tokens that ensures customers' data is encrypted and secured at rest and in transit.

Frequently Asked Questions

Not at all, sensitive payment information will not be shared with you, a token identifier, masked card number and few other information will be provided by noon payments.

If you’ve outsourced all your cardholder data processing functions to an external, PCI compliant payment service provider (such as noon payments), you’ll qualify for SAQ A.

It’s designed for merchants that rely entirely on third-party payment service providers to handle cardholder data, and where the merchant has no impact over the security of the transaction.

SAQ A is the simplest, most streamlined questionnaire; and, at just 22 questions, the shortest.

Yes, it is recommended that customer consent is taken before saving the card details.